Mississippi and North Carolina, the next Florida and Texas?

I am interested in real estate for the same reason I am interested in technology. I like thinking about the future. And if, in thinking about the future, you can make a prediction which ends up coming to fruition, you can be successful in real estate investing just as you can be successful in angel investing or trading tech stocks. Instead of being bullish on a certain market in technology, like crypto or biotech, you might be bullish on a certain market in real estate, like Miami or Charleston. The analogy doesn’t stop there, but I will stop it there for now.

I was thinking about the future this morning, through a real estate lens. A roundabout train of thought brought me to a possible thesis for real estate investing which I think is both interesting and differentiated – at least, I haven’t heard of it before.

The basic idea is that it could be smart to invest in real estate in states which one can anticipate will reduce their state tax rates in the next decade or so, ideally eliminating their state taxes altogether. If you consider this factor with ignorance of all other factors, the most bullish state would seem to be Mississippi. Yes, Mississippi.

Mississippi has been on a path of lowering state income taxes for some time, most recently increasing the amount of income one can make without paying any state tax, and lowering the flat tax on all income above that from 5% to 4% (source). Moreover, the governor has promised to push for elimination of the state’s income tax entirely (source). If Mississippi dropped their income tax from 4% to 0%, one would have to imagine that it would become some amount more attractive to some number of people already living in the south or elsewhere, where some percentage of those people would decide to move there as a result. With a demand increase and relatively stagnant supply, one would expect the prices to go up. Not to mention, anyone living in or looking to live in the state would have more money to spend for what they would figure to save as a result of no longer having to pay a 4-5% state income tax.

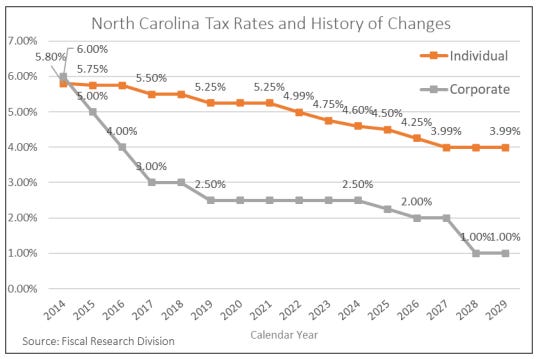

Mississippi is not the only state that one could reasonably bet on with this thesis in mind. Another state which might be more palatable to people moving from the East Coast could be North Carolina. North Carolina has been dropping its state income tax on individuals (as well as on corporations) repetitively for the last decade and plans to continue to do so for the next 5 years (source). One could speculate that North Carolina could further accelerate their plan in the same direction, or at least continue in that direction beyond the current 5-year plan, potentially on a path towards eliminating the state income tax entirely, a la Mississippi.

I’m sure there are other states which might become interesting once you consider them with this thesis in mind, and I am by no means an expert on North Carolina, or Mississippi, nor state taxes, real estate, or really anything written about or contemplated in this piece – I’m just introducing an idea, and I would be thrilled for anyone to run with it however they may.

Further supporting this thesis in my mind is the more general thesis that the impacts of the sudden and significant shift to remote work that resulted from the pandemic have yet to materially play out, and rather, that they have barely even begun. As general as this thesis is, it is one in which I have high conviction. I strongly believe that big changes to the way we live and work are basically baked in for our future, but what exactly those changes will be is still very much up for debate, and depends on human actions, perhaps by people like you and me. That said, one clear change which has already begun to play out in a big way and which may be most predictable to continue has been the migration away from top tier states and cities into states and cities with better weather, more moderate governance, and perhaps more than anything, lower state taxes. This migration pattern was apparent in the first year of the pandemic and has persisted through 2023. I cannot think of many reasons I would expect it to stop or reverse, but I was able to think of one – and that’s what led to this specific thesis.

I wondered what would happen if states like California and New York started lowering their state income taxes, and conversely what would happen if states like Florida and Texas starting increasing them. I don’t think any of this seems likely in the short term, and states like California and New York could very well do the opposite and raise their state income taxes to increase their parasitic efficiency on those residents who do remain, to make up for the losses of those who left. Regardless of whether these specific changes are realistic or not, in such a hypothetical situation, one could imagine that the migration trends as they stand today could slow and perhaps even reverse. From this standpoint, one can start to appreciate how zero state income tax states like Florida and Texas have no upside (in terms of this individual dimension only), and infinite downside, where states like California and New York have the most upside, given they have the most room to lower their state income taxes.

The practical thing to think about however is not which states have the most upside on this dimension, but rather, which states have the highest probability of realizing the largest amount of their upside in this dimension, and of doing so in the relatively near-term future. That’s where I speculate that states like Mississippi and North Carolina come into play.

Broadly speaking, if you think of states as companies and their weather, schools, hospitals, and the like as the various features of their overall product, taxes are like the price, and price matters. The quality of the product determines the price that a company can charge, or the tax that a state can charge, but so does the quality of the competition. The reason that states like California and New York have been able to charge the prices (have the high state incomes taxes) that they have is because they have been objectively great states to live in -- great products. The weather in California is second to none in the country. Silicon Valley has been the tech capital of the world and Hollywood the same for entertainment. If you wanted to work in either industry, the benefits of living and working in the appropriate capital was thought to be well worth the price of admission (high cost of living, including but not limited to taxes). New York has New York City -- the same logic applies. Both states offered high quality products both in absolute terms and relative to other states, their primary competition, and so they were able to charge relatively high prices, and the people who could pay them would.

The pandemic leveled the playing field in terms of state-to-state competition in a way that is hard to overstate. Almost overnight, you could work on “Wall Street” while living on Main Street or work in “Silicon Valley” while living in Appalachian Valley, all thanks to remote work. In short, the availability of job opportunities which previously was far superior in some states and cities versus others became far more evenly distributed.

The sudden geographical redistribution of job opportunities was not the only element that changed, though it was the most abrupt. While there are many factors which remain the same, such as the weather, others unrelated to remote work are also changing. For example, cities like San Francisco and Los Angeles have become increasingly dangerous, crime-ridden, and overrun with homeless, while others like New York City and Philadelphia have reverted to "run down" chapters from their pasts. I’m not saying these cities are terrible. I enjoyed visiting both NYC and LA in the last few months and I am still somewhat biased as someone who grew up in the northeast to think there is no place like New York, but I’m less interested in living in these cities than I have been in the past, having lived in three of the four I mentioned before.

So zero income tax states like Florida and Texas have captured many of the outflows from California and New York. But the positive trends for these two states are obvious at this point. So I’m thinking about what’s less obvious. And that’s what leads me to states like Mississippi and North Carolina. But I’d be curious to hear what you think. Correct me where I’m wrong. Expand on my thesis if you can. Write a response blog, or comment in a tweet. We are only at the very beginning of the future, and I hope this is just the beginning of this discussion.